12 Essential Strategies For Umass Boston Bursar's Office Success Guaranteed

The University of Massachusetts Boston's Bursar's Office plays a vital role in managing the financial aspects of the university, ensuring that students, faculty, and staff have a seamless experience when it comes to tuition, fees, and other financial transactions. To achieve success in the UMass Boston Bursar's Office, it is essential to implement effective strategies that cater to the diverse needs of the university community. In this article, we will delve into 12 essential strategies that can guarantee success for the UMass Boston Bursar's Office.

Understanding the Role of the Bursar’s Office

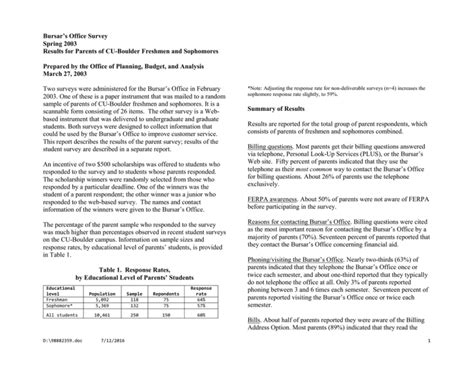

The Bursar’s Office is responsible for managing the financial operations of the university, including tuition and fee billing, payment processing, financial aid disbursement, and refund processing. The office also provides financial counseling and guidance to students and their families. To succeed, the Bursar’s Office must have a deep understanding of the university’s financial policies and procedures, as well as the needs and expectations of the students, faculty, and staff. Effective communication is crucial in ensuring that all stakeholders are informed and aware of the financial policies and procedures. The office must also stay up-to-date with financial regulations and compliance requirements to avoid any potential risks or penalties.

Strategy 1: Implementing Efficient Payment Processing Systems

The Bursar’s Office must implement efficient payment processing systems that allow students to make payments quickly and easily. This can include online payment portals, mobile payment apps, and in-person payment options. Streamlining payment processes can help reduce wait times, improve customer satisfaction, and increase revenue. The office can also consider implementing payment plans that allow students to pay their tuition and fees in installments, making it more manageable for them to pay their bills on time.

| Payment Method | Benefits |

|---|---|

| Online Payment Portal | Convenient, secure, and accessible 24/7 |

| Mobile Payment App | Easy to use, fast, and convenient |

| In-Person Payment | Personalized service, immediate processing |

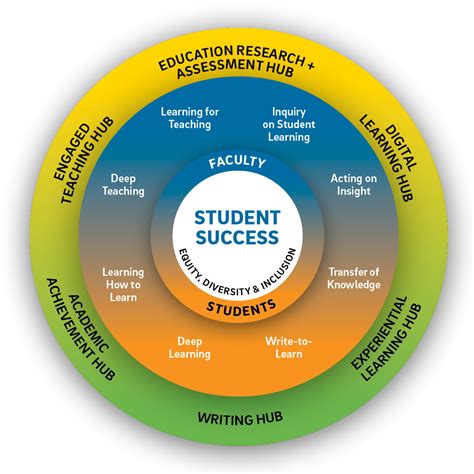

Developing a Comprehensive Financial Literacy Program

A comprehensive financial literacy program can help students understand the importance of managing their finances effectively. The program can include workshops, seminars, and online resources that provide students with the knowledge and skills they need to make informed financial decisions. Financial education is essential in helping students avoid debt, manage their finances, and achieve long-term financial stability. The office can also partner with financial institutions to provide students with access to low-cost banking services and financial products.

Strategy 2: Providing Personalized Financial Counseling

The Bursar’s Office must provide personalized financial counseling to students who need help managing their finances. This can include one-on-one meetings with financial advisors, financial planning workshops, and online resources. Personalized financial counseling can help students create a budget, manage their debt, and achieve their long-term financial goals. The office can also use data analytics to identify students who may be at risk of financial difficulties and provide them with targeted support and guidance.

- One-on-one meetings with financial advisors

- Financial planning workshops

- Online resources and financial tools

Enhancing Customer Service and Support

The Bursar’s Office must provide excellent customer service and support to students, faculty, and staff. This can include responding to phone calls and emails, providing in-person support, and offering online resources and FAQs. Customer service is essential in ensuring that stakeholders have a positive experience when interacting with the Bursar’s Office. The office can also use customer feedback to identify areas for improvement and make changes to its policies and procedures.

Strategy 3: Implementing a Comprehensive Communication Plan

The Bursar’s Office must implement a comprehensive communication plan that keeps students, faculty, and staff informed about financial policies, procedures, and deadlines. This can include email notifications, text alerts, and social media updates. Effective communication can help reduce confusion, improve customer satisfaction, and increase revenue. The office can also use communication metrics to track the effectiveness of its communication plan and make adjustments as needed.

What are the benefits of implementing a comprehensive financial literacy program?

+A comprehensive financial literacy program can help students understand the importance of managing their finances effectively, avoid debt, and achieve long-term financial stability. It can also help reduce the number of students who struggle with financial difficulties and improve overall student success.

Improving Operational Efficiency and Productivity

The Bursar’s Office must improve operational efficiency and productivity by streamlining processes, reducing paperwork, and implementing technology solutions. This can include implementing automated payment processing systems, electronic billing and payment systems, and online financial aid applications. Process improvements can help reduce wait times, improve customer satisfaction, and increase revenue. The office can also use data analytics to identify areas for improvement and track the effectiveness of its process improvements.

Strategy 4: Implementing a Paperless Office Initiative

The Bursar’s Office must implement a paperless office initiative that reduces the use of paper and improves operational efficiency. This can include implementing electronic billing and payment systems, online financial aid applications, and digital document management systems. Going paperless can help reduce waste, improve customer satisfaction, and increase revenue. The office can also use sustainability metrics to track the environmental impact of its operations and make adjustments as needed.

| Process Improvement | Benefits |

|---|---|

| Automated Payment Processing | Reduced wait times, improved customer satisfaction |

| Electronic Billing and Payment | Increased revenue, reduced paperwork |

| Online Financial Aid Applications | Improved customer satisfaction, reduced processing time |

Developing Strategic Partnerships and Collaborations

The Bursar’s Office must develop strategic partnerships and collaborations with other departments and organizations to improve financial operations and student success. This can include partnering with financial institutions to provide students with access to low-cost banking services and financial products, collaborating with academic departments to provide financial literacy programs and resources, and working with student organizations to provide financial support and guidance. Strategic partnerships can help improve financial operations, increase revenue, and enhance student success. The office can also use partnership metrics to track the effectiveness of its partnerships and make adjustments as needed.

Strategy 5: Building Relationships with Financial Institutions

The Bursar’s Office must build relationships with financial institutions to provide students with access to low-cost banking services and financial products. This can include partnering with banks and credit unions to offer low-cost checking and savings accounts, credit cards, and loans. Financial partnerships can help improve financial operations, increase revenue, and enhance student success. The office can also use financial metrics to track the effectiveness of its financial partnerships and make adjustments as needed.

- Partnering with banks and credit unions

- Offering low-cost checking and savings accounts

- Providing access to credit cards and loans

Enhancing Financial Aid and Scholarship Programs

The Bursar’s Office must enhance financial aid and scholarship programs to improve student success and retention. This can include implementing need-based and merit-based aid programs, scholarship programs, and emergency loan programs.