16 Expert Advice For Protecting Your Umass Amherst Debit Card From Fraud And Theft

The University of Massachusetts Amherst debit card, also known as the UCard, is a convenient way for students, faculty, and staff to make purchases on and off campus. However, like any debit card, it is vulnerable to fraud and theft. To protect your UMass Amherst debit card from unauthorized transactions, it is essential to take certain precautions. In this article, we will provide 16 expert tips on how to safeguard your card and prevent financial losses.

Understanding the Risks of Debit Card Fraud

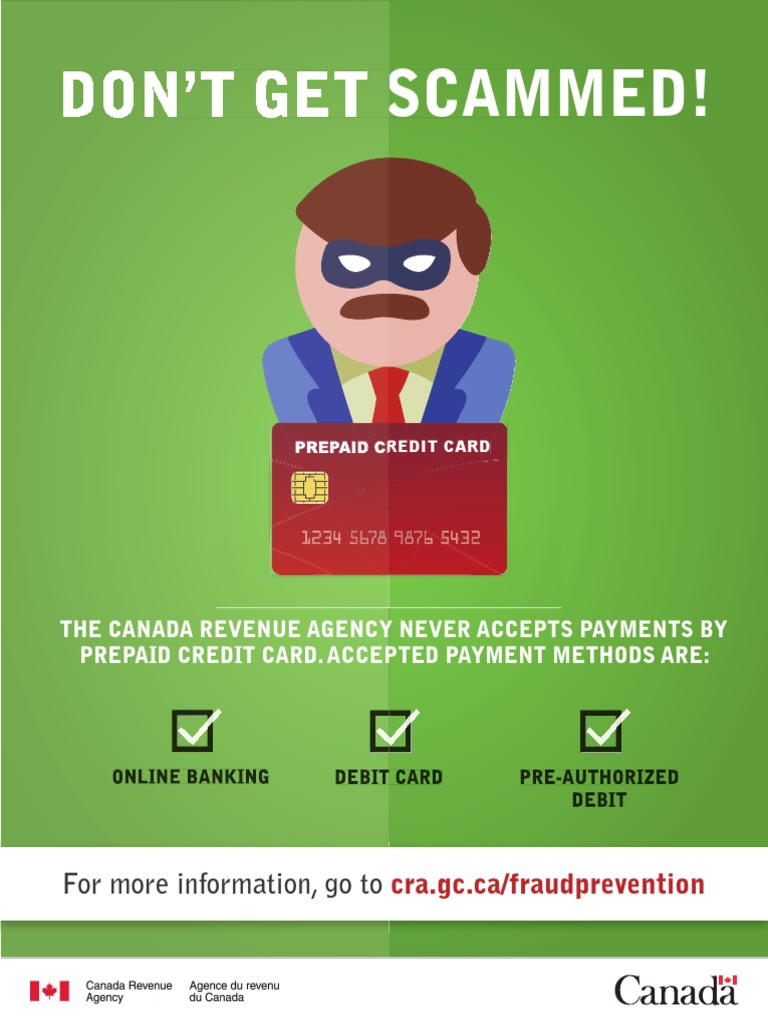

Debit card fraud can occur in various ways, including skimming, where a thief attaches a device to an ATM or card reader to capture card information, or phishing, where a scammer tricks the cardholder into revealing their card details. Additionally, lost or stolen cards can be used to make unauthorized transactions. According to the Federal Trade Commission (FTC), debit card fraud is a significant concern, with millions of dollars lost each year.

Best Practices for Securing Your UMass Amherst Debit Card

To minimize the risk of debit card fraud, it is crucial to follow best practices for securing your card. Here are some expert tips:

- Monitor your account activity regularly to detect any suspicious transactions.

- Keep your card information confidential and never share it with anyone.

- Use strong PINs and passwords to prevent unauthorized access to your account.

- Avoid using public computers or unsecured Wi-Fi networks to access your account information.

- Report lost or stolen cards immediately to prevent unauthorized transactions.

| Security Measure | Description |

|---|---|

| Card Verification Value (CVV) | A 3- or 4-digit code on the back of the card that provides an additional layer of security. |

| Chip Technology | A secure microchip embedded in the card that makes it difficult to counterfeit. |

| Zero-Liability Policy | A policy that protects cardholders from financial losses due to unauthorized transactions. |

Additional Tips for Protecting Your UMass Amherst Debit Card

In addition to the best practices mentioned earlier, here are some additional tips to protect your card:

- Keep your card in a safe place, such as a wallet or purse, to prevent loss or theft.

- Avoid using your card at suspicious ATMs or merchants that may be vulnerable to skimming or other types of fraud.

- Use two-factor authentication whenever possible to add an extra layer of security to your transactions.

- Regularly update your account information to ensure that your contact details are current and accurate.

- Be cautious of phishing scams that may attempt to trick you into revealing your card information.

What should I do if my UMass Amherst debit card is lost or stolen?

+If your card is lost or stolen, report it immediately to the UMass Amherst Bursar's Office or the card issuer to prevent unauthorized transactions. You can also use the UMass Amherst mobile app to report a lost or stolen card and request a replacement.

How can I monitor my account activity to detect suspicious transactions?

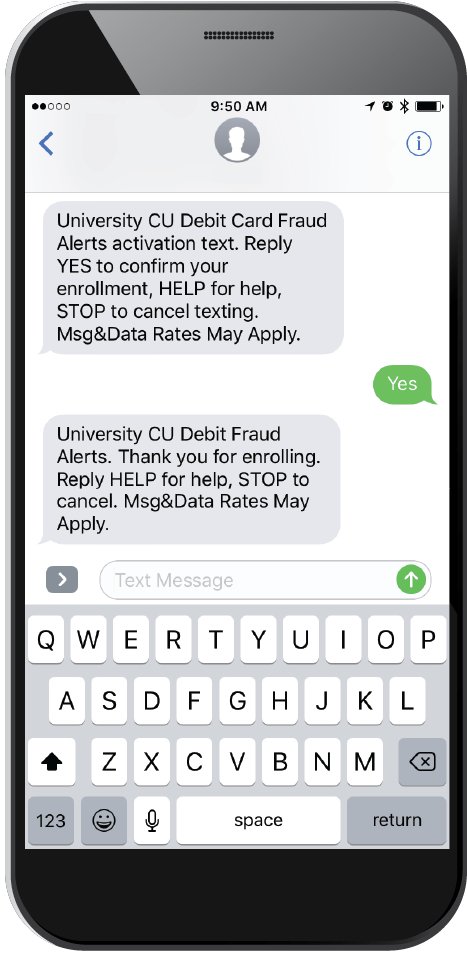

+You can monitor your account activity by logging into your online account or using the UMass Amherst mobile app. You can also set up account alerts to notify you of suspicious transactions or low account balances.

In conclusion, protecting your UMass Amherst debit card from fraud and theft requires a combination of best practices, security measures, and awareness of potential risks. By following the expert tips outlined in this article, you can minimize the risk of unauthorized transactions and ensure the security of your card.