How To Avoid Umass Amherst Debit Card Fees With Smart Banking Practices

As a student at the University of Massachusetts Amherst, managing your finances effectively is crucial to avoid unnecessary expenses, including debit card fees. The UMass Amherst debit card, offered in partnership with a banking institution, provides a convenient way to access your funds. However, like any debit card, it comes with potential fees that can add up if not managed properly. By adopting smart banking practices, you can minimize or completely avoid these fees, ensuring your money goes further.

Understanding Debit Card Fees

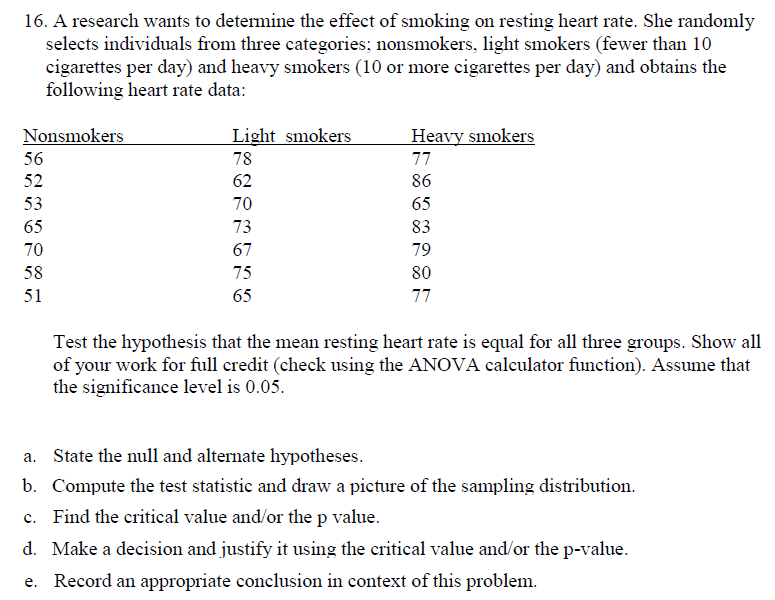

Debit card fees can vary widely depending on the bank and the type of transaction. Common fees include maintenance fees, overdraft fees, ATM fees, and foreign transaction fees. Maintenance fees are charged periodically for having an account, overdraft fees occur when you spend more than you have, ATM fees are charged for using out-of-network ATMs, and foreign transaction fees apply when you make purchases abroad or online with foreign merchants. Understanding these fees is the first step to avoiding them.

Avoiding Maintenance Fees

To avoid maintenance fees, ensure you meet the bank’s requirements, which often include maintaining a minimum balance, setting up direct deposit, or making a certain number of transactions per month. For example, if the bank requires a minimum balance of $1,500 to waive the fee, make sure you don’t fall below this threshold. Direct deposit can also be a convenient way to meet this requirement, as it ensures regular deposits into your account.

| Fee Type | Description | Avoidance Strategy |

|---|---|---|

| Maintenance Fee | Periodic fee for account maintenance | Maintain minimum balance, set up direct deposit, or meet transaction requirements |

| Overdraft Fee | Fee for transactions exceeding account balance | Monitor account balance closely, opt-out of overdraft protection, or set up overdraft transfer from another account |

| ATM Fee | Fee for using out-of-network ATMs | Use in-network ATMs, plan withdrawals, or consider an account with ATM fee rebates |

| Foreign Transaction Fee | Fee for international transactions | Use a debit card with no foreign transaction fees, pay in local currency when abroad, or avoid international transactions when possible |

Smart Banking Practices for Fee Avoidance

Implementing smart banking practices is key to minimizing debit card fees. This includes monitoring your account balance regularly to avoid overdrafts, using in-network ATMs to avoid ATM fees, and choosing the right account that aligns with your banking needs and has minimal fees. Additionally, setting up account alerts can help you stay on top of your account activity and balance, allowing for prompt action if necessary.

Choosing the Right Account

When selecting a debit card or bank account, consider the fees associated with the account and how they align with your financial habits. Look for accounts with low or no fees, especially if you tend to keep a low balance or use out-of-network ATMs frequently. Some accounts offer fee waivers under certain conditions, such as student status or military affiliation, which could be beneficial depending on your situation.

Moreover, consider the convenience and accessibility of the bank's services. An institution with a wide ATM network and user-friendly online banking platform can make it easier to manage your finances effectively and avoid unnecessary fees.

How can I avoid overdraft fees on my UMass Amherst debit card?

+To avoid overdraft fees, regularly monitor your account balance, consider opting out of overdraft protection, or set up an overdraft transfer from another account. This ensures you don't spend more than you have, thus avoiding the fee.

What are the benefits of using in-network ATMs?

+Using in-network ATMs helps you avoid ATM fees charged by the bank for using out-of-network machines. This can save you money, especially if you withdraw cash frequently. Planning your withdrawals and using in-network ATMs can significantly reduce your banking costs.

In conclusion, avoiding UMass Amherst debit card fees requires a combination of understanding the fee structure, adopting smart banking practices, and choosing the right bank account. By being proactive and informed, you can minimize unnecessary expenses and make the most of your financial resources. Remember, smart banking is not just about avoiding fees but also about managing your finances effectively to achieve your long-term financial goals.