How To Choose Umass Amherst Health Insurance Dental And Vision Plans

Choosing the right health insurance, dental, and vision plans is a crucial decision for students and employees at the University of Massachusetts Amherst (UMass Amherst). With various options available, it's essential to consider individual needs, budget, and preferences when selecting a plan. In this article, we will provide a comprehensive guide on how to choose UMass Amherst health insurance, dental, and vision plans, highlighting key factors to consider, plan options, and expert insights.

Understanding UMass Amherst Health Insurance Options

UMass Amherst offers a range of health insurance plans to its students and employees through the University Health Services (UHS) and the Group Insurance Commission (GIC). The plans are designed to provide comprehensive coverage, including medical, prescription, dental, and vision care. To choose the right plan, it’s essential to understand the different options available, including:

- Student Health Insurance Plan (SHIP): A mandatory plan for all students, providing comprehensive coverage, including medical, prescription, dental, and vision care.

- Group Insurance Commission (GIC) Plans: Offers a range of plans for employees, including medical, dental, and vision coverage.

- Voluntary Plans: Additional plans, such as dental and vision, that can be purchased separately or in combination with other plans.

Factors to Consider When Choosing a Plan

When selecting a health insurance, dental, and vision plan, consider the following factors:

Network providers and coverage areas are crucial, especially if you have existing healthcare providers or prefer a specific network. Cost-sharing mechanisms, such as copays, deductibles, and coinsurance, can impact out-of-pocket expenses. Maximum out-of-pocket limits and prescription coverage are also essential considerations. Additionally, dental and vision coverage options, including routine cleanings, fillings, and eye exams, should be evaluated.

| Plan Type | Provider Network | Cost-Sharing | Maximum Out-of-Pocket |

|---|---|---|---|

| SHIP | National network | $20 copay, $1,000 deductible | $6,000 |

| GIC Plan 1 | Regional network | $30 copay, $500 deductible | $4,000 |

| Voluntary Dental Plan | Local network | $10 copay, $50 deductible | $1,000 |

UMass Amherst Dental and Vision Plans

Dental and vision plans are essential components of overall health and wellness. UMass Amherst offers various dental and vision plans, including:

- UMass Amherst Dental Plan: A voluntary plan providing coverage for routine cleanings, fillings, and other dental services.

- UMass Amherst Vision Plan: A voluntary plan offering coverage for eye exams, glasses, and contact lenses.

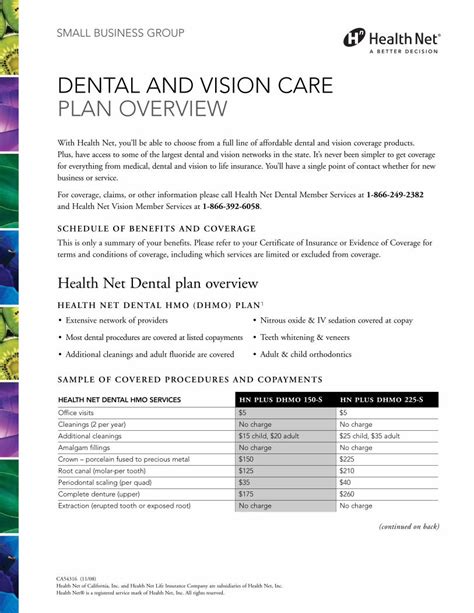

Plan Details and Comparison

When selecting a dental or vision plan, consider the following details:

The UMass Amherst Dental Plan covers 100% of routine cleanings and exams, with a 10 copay for fillings and other services. The <strong>UMass Amherst Vision Plan</strong> covers 100% of eye exams, with a 20 copay for glasses and contact lenses. Compare the plans using the following table:

| Plan Type | Coverage | Copay | Deductible |

|---|---|---|---|

| UMass Amherst Dental Plan | 100% routine cleanings and exams | $10 | $50 |

| UMass Amherst Vision Plan | 100% eye exams | $20 | $0 |

What is the deadline for enrolling in a UMass Amherst health insurance plan?

+The deadline for enrolling in a UMass Amherst health insurance plan varies depending on the plan and individual circumstances. It's essential to review the plan's enrollment deadlines and eligibility requirements to ensure timely enrollment.

Can I purchase a UMass Amherst dental or vision plan separately from a health insurance plan?

+Yes, UMass Amherst offers voluntary dental and vision plans that can be purchased separately from health insurance plans. These plans provide additional coverage for dental and vision care, and can be tailored to individual needs and budgets.

In conclusion, choosing the right UMass Amherst health insurance, dental, and vision plans requires careful consideration of individual needs, budget, and preferences. By understanding the different plan options, factors to consider, and plan details, individuals can make informed decisions and select the plans that best meet their needs. Remember to review the plan’s summary of benefits and coverage, and consider consulting with a licensed insurance professional or UMass Amherst’s health insurance experts for personalized guidance.