How To Get Umass Amherst Paycheck Advances In Emergency Situations Quickly

The University of Massachusetts Amherst (UMass Amherst) offers various financial assistance programs to support its employees during emergency situations. One such program is the paycheck advance, which provides employees with a portion of their upcoming paycheck before the actual pay date. This can be a valuable resource for employees facing unexpected expenses or financial difficulties. In this article, we will explore the process of obtaining a paycheck advance at UMass Amherst and the requirements that must be met.

Eligibility and Requirements

To be eligible for a paycheck advance at UMass Amherst, employees must meet certain requirements. These include being a regular, benefits-eligible employee with a minimum of six months of service, having a satisfactory performance record, and not having any outstanding debts or financial obligations to the university. Additionally, employees must have a valid bank account and be able to repay the advance through payroll deductions.

Types of Paycheck Advances

UMass Amherst offers two types of paycheck advances: emergency loans and payroll advances. Emergency loans are available to employees who are experiencing financial hardship due to unexpected expenses, such as medical bills or car repairs. Payroll advances, on the other hand, are available to employees who need access to their upcoming paycheck before the actual pay date. Both types of advances are subject to certain terms and conditions, including repayment schedules and interest rates.

| Type of Advance | Eligibility | Repayment Terms |

|---|---|---|

| Emergency Loan | Regular, benefits-eligible employees with 6+ months of service | Repaid through payroll deductions over 6-12 months |

| Payroll Advance | Regular, benefits-eligible employees with 6+ months of service | Repaid through payroll deductions on the next pay date |

Application Process

To apply for a paycheck advance at UMass Amherst, employees must submit a request to the university’s Human Resources department. The request must include documentation of the emergency or financial hardship, as well as proof of income and expenses. Employees can submit their requests online or in person, and they will be reviewed on a case-by-case basis.

Documentation Requirements

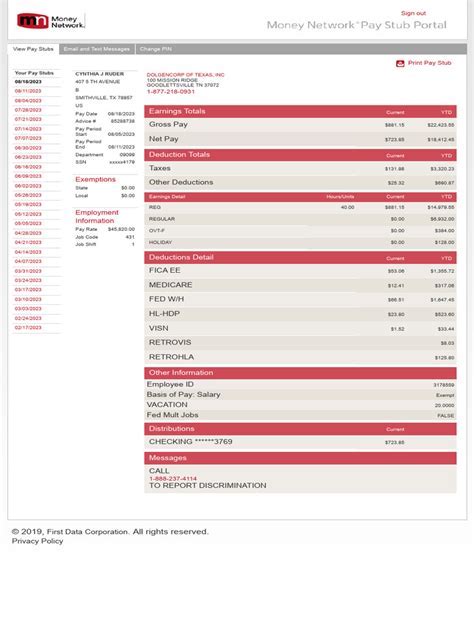

Employees must provide certain documentation to support their request for a paycheck advance. This may include pay stubs, bank statements, and proof of expenses, such as medical bills or repair estimates. The university may also require additional documentation, such as a budget or financial plan, to ensure that the employee can repay the advance.

- Pay stubs for the past 3 months

- Bank statements for the past 2 months

- Proof of expenses (e.g. medical bills, repair estimates)

- Budget or financial plan (if required)

Repayment Terms

Paycheck advances at UMass Amherst are subject to certain repayment terms. Employees who receive an emergency loan must repay the loan through payroll deductions over 6-12 months. Payroll advances, on the other hand, are repaid through payroll deductions on the next pay date. Employees who fail to repay their advances may be subject to disciplinary action, including termination of employment.

Consequences of Default

Employees who default on their paycheck advances may face serious consequences, including damage to their credit score, disciplinary action, and termination of employment. It is essential that employees carefully review their financial situation and ensure that they can repay the advance before requesting it.

How do I apply for a paycheck advance at UMass Amherst?

+To apply for a paycheck advance, employees must submit a request to the university's Human Resources department. The request must include documentation of the emergency or financial hardship, as well as proof of income and expenses.

What are the repayment terms for a paycheck advance at UMass Amherst?

+Paycheck advances at UMass Amherst are subject to certain repayment terms. Employees who receive an emergency loan must repay the loan through payroll deductions over 6-12 months. Payroll advances are repaid through payroll deductions on the next pay date.

What happens if I default on my paycheck advance at UMass Amherst?

+Employees who default on their paycheck advances may face serious consequences, including damage to their credit score, disciplinary action, and termination of employment. It is essential that employees carefully review their financial situation and ensure that they can repay the advance before requesting it.

In conclusion, paycheck advances can be a valuable resource for UMass Amherst employees facing emergency situations or financial difficulties. However, it is essential that employees carefully review their financial situation and ensure that they can repay the advance before requesting it. By following the application process and repayment terms outlined above, employees can access the financial assistance they need while avoiding potential consequences of default.