How To Make Umass Amherst Quickpay Payments With A Credit Card

The University of Massachusetts Amherst offers a convenient online payment system, known as QuickPay, which allows students and their authorized users to make payments towards tuition, fees, and other university-related expenses. Making payments with a credit card through QuickPay is a straightforward process. To initiate the process, users must first log in to the SPIRE system, which is the university's online student information system. SPIRE provides a secure and user-friendly interface for managing various aspects of a student's academic and financial records.

Accessing QuickPay through SPIRE

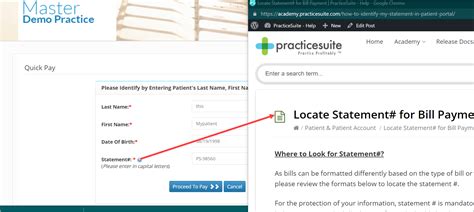

To access QuickPay, users need to navigate to the UMass Amherst website and click on the SPIRE login link. Once logged in, they can select the “Finances” tab, followed by “Make a Payment” or “View/Pay Bill” to proceed to the QuickPay portal. It is essential to note that only authorized users, including students and those they have granted access to their account, can make payments through QuickPay. Authorized users must be set up by the student in SPIRE beforehand. The setup process involves the student logging into SPIRE, navigating to the “Finances” section, and then clicking on “Authorize Payers” to add a new authorized user.

Adding Authorized Users

Adding an authorized user is a simple process that requires the student to provide the user’s name and email address. The authorized user will then receive an email with instructions on how to create their own login credentials for the QuickPay system. This step is crucial for ensuring that FERPA (Family Educational Rights and Privacy Act) regulations are complied with, as it allows students to control who can view and manage their financial information. Once an authorized user is set up, they can make payments on behalf of the student using their credit card.

The QuickPay system accepts several types of credit cards, including Visa, Mastercard, American Express, and Discover. However, it's worth noting that a convenience fee is charged for credit card payments. This fee is a percentage of the payment amount and is used to cover the costs associated with processing credit card transactions. The exact percentage may vary, so it's advisable to check the QuickPay website for the most current information.

| Payment Method | Convenience Fee |

|---|---|

| Visa | 2.75% of payment amount |

| Mastercard | 2.75% of payment amount |

| American Express | 2.75% of payment amount |

| Discover | 2.75% of payment amount |

Making a Payment with a Credit Card

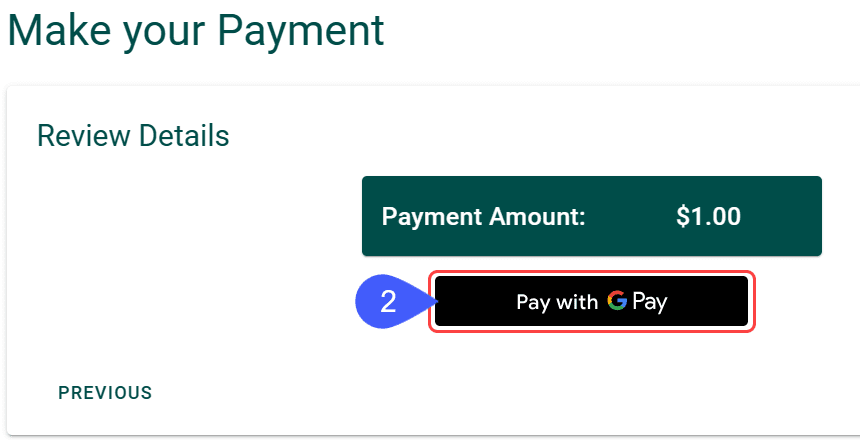

Once in the QuickPay portal, users can select the “Make a Payment” option and choose “Credit Card” as their payment method. They will then be prompted to enter their credit card details, including the card number, expiration date, and security code. It’s crucial to ensure that the credit card information is entered correctly to avoid any processing errors. After confirming the payment details, including the payment amount and convenience fee, the user can submit the payment.

After a payment is made, both the student and the authorized user (if applicable) will receive an email confirmation. This confirmation serves as a receipt and includes details about the payment, such as the amount paid, the payment method, and the date of payment. It's a good practice to retain this confirmation for personal records, as it may be needed for future reference or tax purposes.

Payment Plans and Installment Options

UMass Amherst also offers payment plans that allow students to pay their tuition and fees in installments rather than in a single lump sum. These plans can be particularly useful for managing larger expenses and can help in budgeting for educational costs throughout the semester. The payment plan option is typically available through QuickPay and may require an initial payment upon enrollment, followed by scheduled payments on specific due dates. Interest is not charged on payment plans, but a small enrollment fee may apply.

Enrolling in a payment plan involves selecting the payment plan option in QuickPay, reviewing the payment schedule, and agreeing to the terms and conditions. It's vital to carefully review the payment due dates and amounts to ensure timely payments are made. Late payments may result in late fees and could impact the student's ability to enroll in future payment plans.

Can international students use QuickPay to make payments with a credit card?

+Yes, international students can use QuickPay to make payments with a credit card. However, they should be aware that their bank may charge an additional foreign transaction fee. It's recommended that international students check with their bank to understand any potential fees before making a payment.

How do I set up an authorized user in SPIRE?

+To set up an authorized user, log in to SPIRE, navigate to the "Finances" tab, and select "Authorize Payers." Then, click on "Add Authorized User" and follow the prompts to enter the user's name and email address. The authorized user will receive an email with instructions on how to create their login credentials for QuickPay.

In conclusion, making UMass Amherst QuickPay payments with a credit card is a convenient and straightforward process. By understanding the steps involved, including logging into SPIRE, accessing QuickPay, and selecting the credit card payment option, students and authorized users can efficiently manage their university-related expenses. It’s also important to be aware of the convenience fee associated with credit card payments and to consider alternative payment methods, such as e-checks, to minimize additional costs. For those who prefer to budget their expenses over time, UMass Amherst’s payment plans offer a flexible and interest-free way to pay tuition and fees in installments.