How To Optimize Umass Amherst Paycheck Budgeting For Financial Success

Optimizing paycheck budgeting is a crucial aspect of achieving financial success, especially for individuals associated with the University of Massachusetts Amherst (UMass Amherst). The university, being one of the largest public research universities in the Northeast, attracts a diverse community of students, faculty, and staff. Effective budgeting helps individuals manage their finances wisely, ensuring they can meet their needs, achieve their goals, and build a secure financial future. In this context, understanding how to optimize UMass Amherst paycheck budgeting for financial success is essential.

Understanding the Basics of Paycheck Budgeting

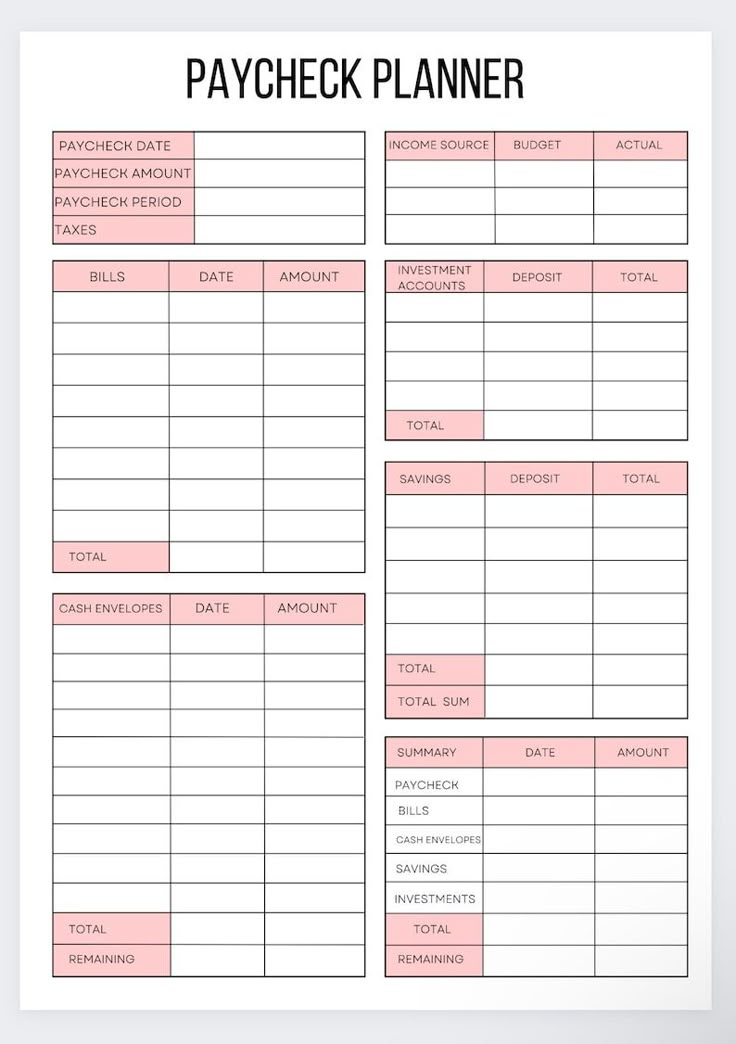

Before diving into the specifics of optimizing paycheck budgeting, it’s essential to understand the basics. Paycheck budgeting involves allocating the income received from each paycheck into different categories to manage expenses, savings, and debt repayment effectively. The key to successful budgeting is to ensure that the allocations align with the individual’s financial goals and priorities. For UMass Amherst students, faculty, and staff, this might include budgeting for tuition, living expenses, research materials, or professional development opportunities.

50/30/20 Rule

A widely recommended budgeting strategy is the 50/30/20 rule. This rule suggests allocating 50% of the income towards necessary expenses such as rent, utilities, and groceries. 30% should go towards discretionary spending, which includes entertainment, hobbies, and lifestyle upgrades. The remaining 20% should be dedicated to saving and debt repayment. This rule provides a simple framework for individuals to balance their spending and savings, ensuring they are making progress towards their long-term financial goals.

| Category | Percentage of Income |

|---|---|

| Necessary Expenses | 50% |

| Discretionary Spending | 30% |

| Savings and Debt Repayment | 20% |

Optimizing Paycheck Budgeting for UMass Amherst Community

Optimizing paycheck budgeting for financial success involves several steps tailored to the unique needs and challenges faced by the UMass Amherst community. This includes:

- Tracking Expenses: Keeping a record of every transaction can help identify areas where money can be saved. UMass Amherst offers resources and workshops on personal finance that can provide guidance on effective expense tracking.

- Creating a Budget Plan: Based on the income and expenses, creating a budget plan that allocates funds appropriately is crucial. This plan should be flexible to accommodate changes in financial situations.

- Taking Advantage of University Resources: UMass Amherst offers various resources such as financial counseling, budgeting workshops, and employee benefits that can aid in financial planning.

- Avoiding Debt: Minimizing debt, especially high-interest debt, is essential for long-term financial health. The university's financial aid office can provide guidance on managing student loans and other debts.

- Building an Emergency Fund: Having a fund in place for unexpected expenses can prevent going into debt and ensure financial stability. Aim to save 3-6 months' worth of living expenses.

Specific Considerations for Students

For students at UMass Amherst, additional considerations include managing student loans, part-time jobs, and scholarships. It’s essential to understand the terms of any financial aid received and to budget accordingly. Students should also explore ways to minimize their student loan debt, such as applying for scholarships, grants, and choosing income-driven repayment plans when possible.

How can UMass Amherst students manage their financial aid effectively?

+Students can manage their financial aid by understanding the terms of their aid, creating a budget that accounts for their aid, and exploring options to minimize debt, such as scholarships and income-driven repayment plans. The UMass Amherst financial aid office is a valuable resource for guidance.

What resources are available at UMass Amherst for financial planning and budgeting?

+UMass Amherst offers various resources including financial counseling, budgeting workshops, and benefits for employees. The university's website and financial aid office can provide more detailed information on these resources.

In conclusion, optimizing paycheck budgeting for financial success at UMass Amherst requires a tailored approach that considers the unique financial challenges and opportunities available to students, faculty, and staff. By understanding the basics of budgeting, utilizing the 50/30/20 rule, and leveraging university resources, individuals can achieve their financial goals and secure a prosperous financial future.