How To Understand Umass Amherst Paycheck Stubs In 5 Minutes Or Less

Understanding your UMass Amherst paycheck stub is crucial for managing your finances effectively. The paycheck stub, also known as a pay slip, provides a detailed breakdown of your earnings, deductions, and other relevant information. In this article, we will guide you through the process of understanding your UMass Amherst paycheck stub in 5 minutes or less.

Overview of the Paycheck Stub

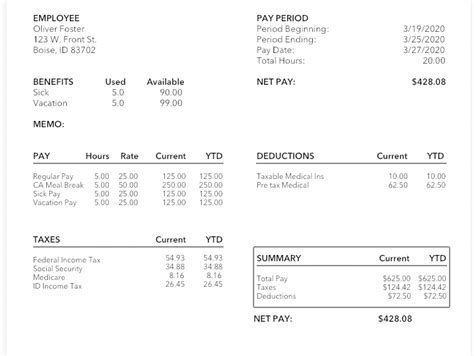

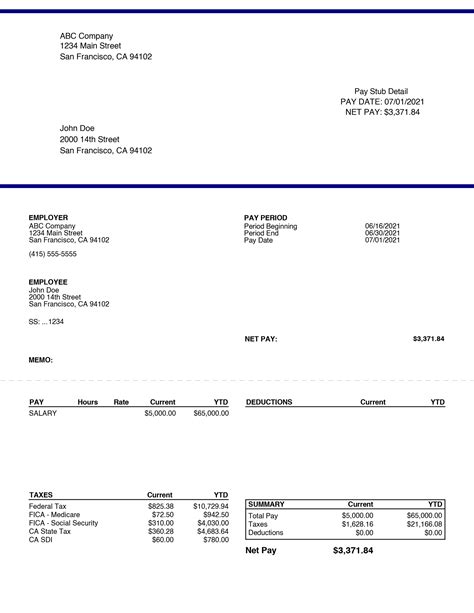

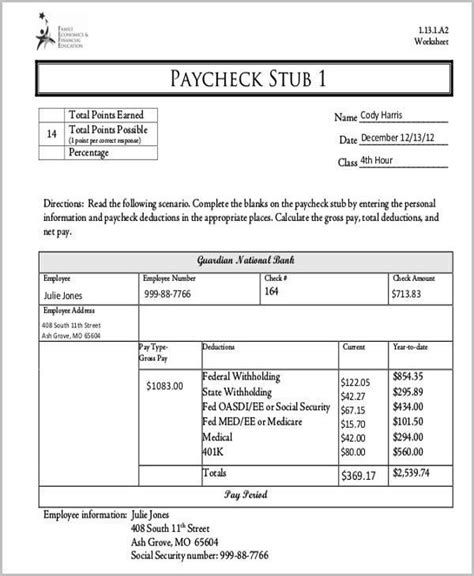

The UMass Amherst paycheck stub typically consists of several sections, including employee information, earnings, deductions, and taxes. The employee information section displays your name, employee ID, and job title. The earnings section shows your gross pay, which is your total pay before deductions, and your net pay, which is your take-home pay after deductions.

Earnings Section

The earnings section is further divided into several sub-sections, including:

- Regular Pay: This is your base pay for the pay period.

- Overtime Pay: This is the pay you receive for working extra hours beyond your regular schedule.

- Bonus Pay: This is any additional pay you receive, such as a signing bonus or a performance bonus.

Deductions Section

The deductions section shows the various deductions made from your pay, including:

- Federal Income Tax: This is the tax deducted from your pay for federal income tax purposes.

- State Income Tax: This is the tax deducted from your pay for state income tax purposes.

- Health Insurance: This is the premium deducted from your pay for health insurance coverage.

- Retirement Plan: This is the contribution deducted from your pay for your retirement plan.

| Category | Amount |

|---|---|

| Gross Pay | $5,000.00 |

| Federal Income Tax | $1,000.00 |

| State Income Tax | $200.00 |

| Health Insurance | $150.00 |

| Retirement Plan | $500.00 |

| Net Pay | $3,150.00 |

Taxes and Benefits

In addition to earnings and deductions, your paycheck stub also displays information about your taxes and benefits. The federal income tax section shows the amount of tax deducted from your pay for federal income tax purposes. The state income tax section shows the amount of tax deducted from your pay for state income tax purposes.

Benefits

The benefits section displays information about your health insurance, retirement plan, and other benefits. The health insurance section shows the premium deducted from your pay for health insurance coverage. The retirement plan section shows the contribution deducted from your pay for your retirement plan.

Understanding your UMass Amherst paycheck stub is crucial for managing your finances effectively. By reviewing your paycheck stub regularly, you can ensure that your earnings and deductions are accurate, and make informed decisions about your taxes and benefits.

What is the difference between gross pay and net pay?

+Gross pay is your total pay before deductions, while net pay is your take-home pay after deductions. Gross pay includes your regular pay, overtime pay, and bonus pay, while net pay is your gross pay minus deductions such as federal income tax, state income tax, health insurance, and retirement plan contributions.

How do I review my paycheck stub for accuracy?

+To review your paycheck stub for accuracy, check your earnings, deductions, and taxes to ensure they are correct. Verify that your gross pay and net pay are accurate, and that your deductions for federal income tax, state income tax, health insurance, and retirement plan contributions are correct. If you notice any discrepancies, contact the UMass Amherst payroll department immediately.

By following these steps and reviewing your paycheck stub regularly, you can ensure that your earnings and deductions are accurate, and make informed decisions about your taxes and benefits. Remember to always review your paycheck stub carefully and contact the UMass Amherst payroll department if you have any questions or concerns.