How To Use Umass Amherst Pay Stub Estimator Tool For Budgeting Purposes

The University of Massachusetts Amherst provides its employees with a pay stub estimator tool to help them estimate their net pay and plan their finances accordingly. This tool is particularly useful for budgeting purposes, as it allows employees to anticipate their take-home pay and make informed decisions about their financial planning. In this article, we will explore how to use the UMass Amherst pay stub estimator tool for budgeting purposes, and provide tips and guidance on how to get the most out of this valuable resource.

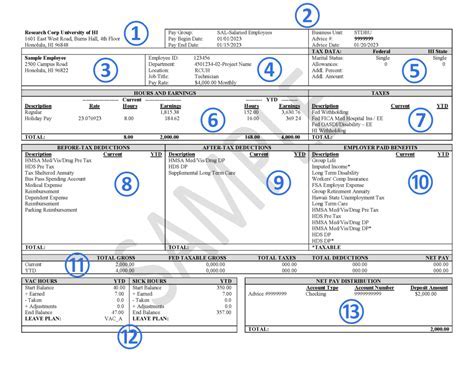

Understanding the Pay Stub Estimator Tool

The pay stub estimator tool is a web-based application that allows UMass Amherst employees to estimate their net pay based on their gross pay, deductions, and other factors. The tool takes into account various factors such as taxes, health insurance premiums, retirement contributions, and other deductions to provide an accurate estimate of an employee’s net pay. To use the tool, employees need to enter their personal and financial information, including their salary, benefits, and deductions.

Inputting Personal and Financial Information

To use the pay stub estimator tool, employees need to input their personal and financial information, including their salary, benefits, and deductions. The tool will ask for the following information:

- Gross pay: This is the employee’s annual or monthly salary before any deductions.

- Tax filing status: This includes single, married, head of household, or qualifying widow(er).

- Number of dependents: This includes children, spouses, or other dependents claimed on the employee’s tax return.

- Health insurance premiums: This includes the cost of health insurance premiums deducted from the employee’s paycheck.

- Retirement contributions: This includes contributions to retirement plans such as 401(k) or 403(b).

- Other deductions: This includes other deductions such as life insurance premiums, charitable contributions, or union dues.

Once the employee has entered their personal and financial information, the tool will calculate their estimated net pay based on the inputted data.

Interpreting the Results

The pay stub estimator tool will provide an estimate of the employee’s net pay, which is the amount of money they can expect to take home after all deductions have been made. The tool will also provide a breakdown of the deductions, including taxes, health insurance premiums, retirement contributions, and other deductions. Employees can use this information to plan their finances, make adjustments to their budget, and anticipate any changes to their net pay.

| Category | Estimated Amount |

|---|---|

| Gross Pay | $50,000 |

| Federal Income Tax | $8,000 |

| State Income Tax | $2,500 |

| Health Insurance Premiums | $3,000 |

| Retirement Contributions | $2,000 |

| Net Pay | $34,500 |

In this example, the employee's estimated net pay is $34,500, which is the amount of money they can expect to take home after all deductions have been made.

Using the Pay Stub Estimator Tool for Budgeting Purposes

The pay stub estimator tool can be a valuable resource for budgeting purposes, as it allows employees to anticipate their net pay and plan their finances accordingly. Here are some tips on how to use the tool for budgeting purposes:

Creating a Budget

Employees can use the pay stub estimator tool to create a budget that takes into account their estimated net pay. They can start by categorizing their expenses into needs (housing, food, transportation, etc.) and wants (entertainment, hobbies, etc.). Then, they can allocate their estimated net pay to each category, making sure to prioritize their needs over their wants.

Adjusting to Changes in Net Pay

Employees can use the pay stub estimator tool to anticipate changes to their net pay, such as changes in taxes, health insurance premiums, or retirement contributions. They can adjust their budget accordingly, making sure to account for any changes in their net pay.

Planning for the Future

Employees can use the pay stub estimator tool to plan for the future, such as planning for retirement or paying off debt. They can use the tool to estimate their net pay in future years, taking into account changes in taxes, health insurance premiums, and retirement contributions.

What is the pay stub estimator tool, and how does it work?

+The pay stub estimator tool is a web-based application that allows UMass Amherst employees to estimate their net pay based on their gross pay, deductions, and other factors. The tool takes into account various factors such as taxes, health insurance premiums, retirement contributions, and other deductions to provide an accurate estimate of an employee’s net pay.

How can I use the pay stub estimator tool for budgeting purposes?

+Employees can use the pay stub estimator tool to create a budget that takes into account their estimated net pay. They can start by categorizing their expenses into needs and wants, and then allocate their estimated net pay to each category. They can also use the tool to anticipate changes to their net pay and adjust their budget accordingly.

Is the pay stub estimator tool accurate, and what factors can affect its accuracy?

+The pay stub estimator tool is only an estimate, and actual net pay may vary based on individual circumstances. Factors that can affect the accuracy of the tool include changes in taxes, health insurance premiums, retirement contributions, and other deductions. Employees should review their actual pay stubs to ensure accuracy and make adjustments to their budget as needed.